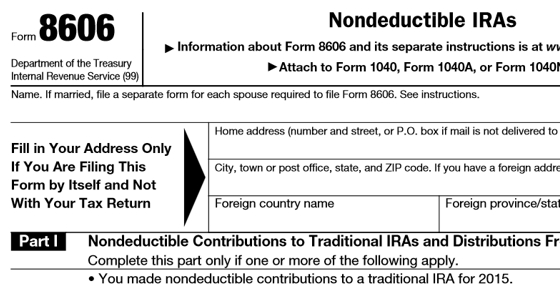

This is the case because Roth IRAs and rollover eligibility have contributed to the rise in the significance of Nondeductible IRAs (b). Due to the growing popularity of Roth individual retirement accounts (Roth IRAs). You must submit the form every year when you get a payout from your Roth IRA or regular IRA.

Whether the assets in your retirement account are traceable to pretax or after-tax contributions is the primary factor determining whether the distribution from your retirement account is taxable. Suppose your assets are held inside a qualifying plan with your employer. As the owner of your IRAs, the obligation falls squarely on your shoulders.

Traditional IRA Contributions

When a taxpayer does not claim a deduction for their contribution to a conventional IRA, it is often for one of two reasons: they are not qualified for the deduction or opt not to claim it. A person qualified to receive the deduction may choose to forego taking it to ensure that any future distributions of the amount will be exempt from both taxes and penalties. Regardless matter the motivation behind it.

Rollover of After

One of the aspects of IRAs that a lot of people aren't aware of is the fact that they may transfer assets that have already been taxed over from their qualifying plan accounts into a conventional IRA. "Form 8606 is not utilized for the year that you make a rollover from a qualified retirement plan to a regular IRA, and the rollover contains nontaxable sums," states Publication 590-A of the Internal Revenue Service. When one of these events occurs, one must fill out Form 8606 for the year they receive a payout from their IRA.

Distributions

Form 8606 has to be submitted annually if a distribution is taken from a regular, SEP, or SIMPLE IRA if any of these IRAs include sums that have been taxed after they have been earned. If a person fails to submit Form 8606, there is a possibility that they may be required to pay income tax as well as an early distribution penalty on sums that should be exempt from both taxes and penalties.

Distributions Are Prorated

When you take a distribution from your conventional IRA, if you have any sums earned after taxes and contributed to the account, you are required to calculate the distribution percentage due to those after-tax earnings. You will have a cost basis equal to the number of your contributions that are net of taxes. A proportional share of the payout's nontaxable element must be considered when calculating the taxable share. For example, a person contributed $2,000 in after-tax monies to a standard individual retirement account (IRA), and the IRA now has a pretax balance of $8,000 (including both contributions and profits) for a total of $10,000.

IRAs Are Aggregated

It is necessary for taxpayers to combine the balances of their regular, SEP, and SIMPLE IRAs before calculating the part of the IRA distribution subject to taxation. Even if the after-tax contribution was only made to a single IRA, you must still comply with this obligation. The person will be able to more easily calculate the part of the taxable dividend thanks to the detailed instructions provided for Part 1 of the form.

Roth IRA Conversions

A person who wishes to convert their conventional, SEP, or SIMPLE IRA into a Roth IRA must differentiate between the assets associated with the conversion and the amounts that reflect ongoing contributions to and profits from the Roth IRA. This difference is required to determine whether any part of a distribution from a Roth IRA is liable to income tax and a penalty.

Distributions from Roth IRAs

It is necessary to fill out Part III of Form 8606 to record distributions received from Roth IRAs. By filling out this part, a person may determine whether or not any amount of the distribution from their Roth IRA is taxable and subject to the early distribution penalty of 10% if it is taken before they reach the age of 5912 years. Whether the assets in your retirement account are traceable to pretax or after-tax contributions is the primary factor determining whether the distribution from your retirement account is taxable.

Recharacterizations

A person must attach a letter (statement) detailing the recharacterization of their Roth conversion or IRA contribution to their tax return. This is the case whether the recharacterization involves the Roth conversion or the IRA contribution. In this letter, for instance, you would include information on the amount credited to the contribution or conversion, as well as the amount allocated to profits (or indicate if there was a loss on the amount).

The Best Bonuses And Promotions Offered By Banks

Difference Between Co-Signing Vs. Co-Owning a Car

How to Get the Most Money for Your Fur Coat

A Successful Coffee Shop

Save Money on a Tight Budget

All About Business Podcasts

Unlocking Tax Benefits: Strategies to Maximize Charitable Donations

NATO: An Essential Overview of Its Role in Global Security and More

An Extensive Trinity Debt Management Review

What Exactly Is a Green Tax?

Exactly what is a BCL (bank confirmation letter)?