Introduction

Besides the legal and ethical implications of not paying your fair share of taxes, tax fraud is a huge problem. Attempting to defraud the Internal Revenue Service (IRS) or another taxing authority can result in severe fines and even jail time. Paying less in taxes than you owe is not the same as taking steps to reduce your tax liability, such as making the maximum contribution to a taxable retirement plan. Therefore, it is recommended that you seek the advice of a tax professional or utilize tax software to help you identify all of the allowable tax deductions and credits. However, it would help if you stayed far away from coworkers encouraging illegal actions like income underreporting.

What is Tax Fraud?

When a person or company knowingly files a false tax return to evade tax obligations, they commit tax fraud. To commit tax fraud, one must essentially falsify a tax return to underpay their taxes. False deductions, personal spending written off as business expenses, a fake SSN, and unreported income are all examples of tax fraud. Using a fake or stolen Social Security number is another method of tax fraud.

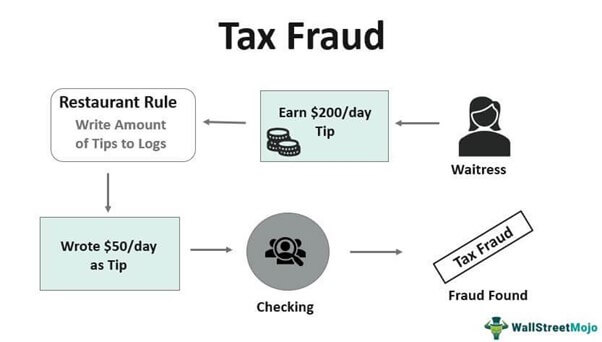

How Tax Fraud Works

Tax fraud occurs when an individual knowingly submits an income tax return that understates their taxable income. Individuals may only be subject to a penalty if they make an honest mistake on their taxes (such as by making a calculation error) or are negligent (such as by forgetting to keep records). Nonetheless, tax fraud is unique since it is an intentional action taken by the taxpayer with the intent to pay less money than is legally owed in taxes dishonestly. You must pay income taxes on the money you make minus any exemptions, deductions, credits, or deductions to which you are entitled. It's possible, nevertheless, that someone who commits tax fraud does so, knowing they're trying to minimize the amount of tax they owe.

For instance, a person practicing tax fraud can deposit their money into an undisclosed bank account instead of declaring all their income. Or, a business owner may try to reduce their taxable revenue by reporting high advertising costs when they only spent $5,000. If you commit tax fraud, you could face legal consequences. If the government suspects civil fraud, it may seek to collect the total amount of taxes due, plus interest and penalties. However, those who commit tax fraud may face criminal charges due to their activities. Tax and duty evasion may result in severe monetary fines and jail time.

Tax Fraud vs. Negligence or Avoidance

To reduce one's tax burden dishonestly, one may declare a dependent who does not exist as a dependent on one's tax return. Contrarily, there may be further inquiry into whether or not it was negligent in using the long-term capital gain rate on a short-term profit. The Internal Revenue Service (IRS) reserves the right to assess a penalty against a careless taxpayer equal to twenty percent of the underpayment, even though mistakes that can be attributed to negligence are not purposeful. The United States Internal Revenue Code is an intricate body of tax laws and regulations, and as a result, many tax preparers will make stupid mistakes. However, tax avoidance—legally reducing one's taxable income by taking advantage of loopholes in the tax code—should not be confused with tax evasion. Tax authorities frown upon tax evasion even though it does not represent a direct violation of the law since it has the potential to undermine the ultimate aim of tax legislation.

Additional Frequent Types of Tax Fraud

The IRS's Criminal Investigation (CI) division investigates cases of suspected tax evasion, including those involving tax-related money laundering and the illicit monetization of legitimate businesses' intellectual property. CI looks into the following types of criminal behavior:

Employment And Payroll Tax Fraud

Payroll-related tax issues are common. The IRS investigates and prosecutes numerous types of tax avoidance activities. Paying employees in cash instead of withholding taxes, neglecting to provide accurate payroll data, failing to remit federal unemployment and social security and withholding taxes are all illegal practices.

Despite widespread knowledge that filing a fraudulent income tax return can lead to legal repercussions, tax refund fraud is a pervasive problem. Individuals and tax preparers may illegally resort to identity theft and fraud to get an excessive tax refund. This is also the terrain for taking advantage of bogus tax breaks and making up costs for your business.

Conclusion

To commit tax fraud, one must engage in tax evasion, which occurs when a person or business dishonestly attempts to reduce their tax burden by, for example, failing to report revenue or making up expenses. Either the person or the company can take this step. It also includes smuggling goods subject to taxes such as excise duties, customs duties, or value-added taxes. Millions of dollars are lost annually due to tax evasion, and offenders may face jail time in addition to paying fines, penalties, and interest on their unpaid taxes. Unless it can be proven that the company intentionally avoided paying its taxes, it will typically not be found guilty of the crime. The Internal Revenue Service distinguishes between "fraudulent reporting" and "negligent reporting," which includes reporting errors or omissions.

Should You Buy A House Or A Townhouse?

What Exactly Is Meant by "Current Assets"?

Best Secured Business Credit Cards

The Best Bonuses And Promotions Offered By Banks

Bank Of America Travel Reward Credit Card 2022

Dealing with a Missing Security Deposit: Tips for Tenants

Difference Between Co-Signing Vs. Co-Owning a Car

Save Money on a Tight Budget

All You Need to Learn About: What Is Tax Fraud?

All About Homebuying Resources for Single Parents

Choice Privileges Visa Signature Card Review